The Shift Coming for Finance in 2026

2026 is looking like it will be a critical year for finance leaders. Experts predict that this coming year will be a very pivotal year, with leaders needing to navigate AI disruption, capital pressures, strategic alignment, and supply chain risks.

This week, we’re looking at key insights from the report, covering AI strategies, risk management, and how leaders can maintain credibility in 2026.

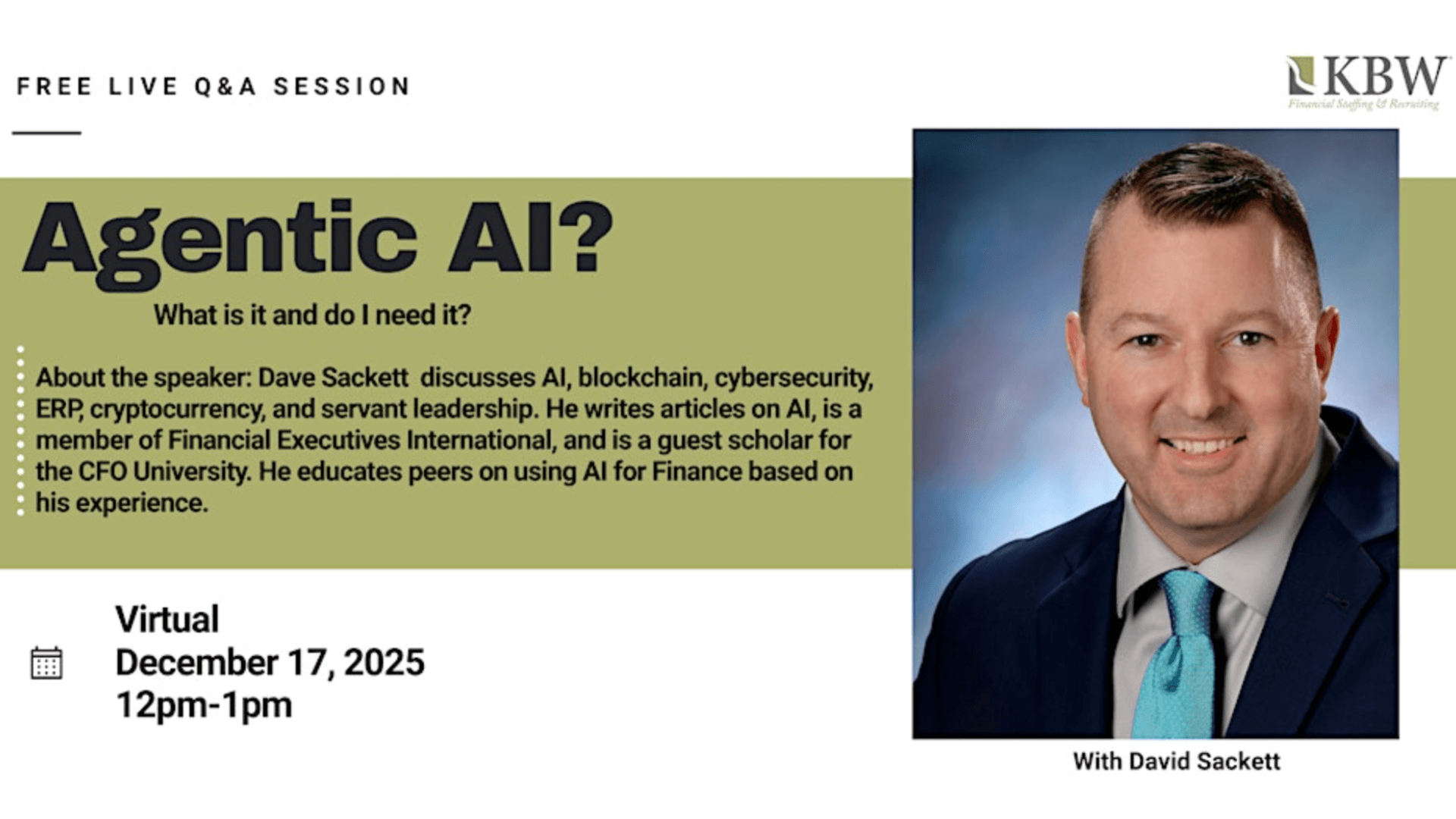

Plus, don’t miss our upcoming live Q&A session on agentic AI on December 17th, with expert Dave Sackett!👇

Free Live Virtual Q&A Session Opportunity!

This Week’s Featured Jobs: Find your next career move

Controller – Dover, NH | $160k-$175k/year

Senior Accountant – Nashua, NH | $95k-$130k/year

Trading Analyst – Boston, MA | $75k-$85k/year

Investment Research Analyst – Portsmouth, NH | $75k-$95k/year

Senior Accountant – Wilmington, MA | $100k-$120k/year

Senior Tax Associate – Bedford, NH | $80k-$100k/year

Tax Analyst – Cambridge, MA | $115k-$130k/year

Tax Manager – Exeter, NH | $140k-$160k/year

Senior Financial Analyst – Salem, NH | $95k-$110k/year

Controller, North America – Natick, MA | $190k-$220k/year

Controller – Springfield, MA | $100k-$110k/year

Wealth Tax Strategist – Winchester, MA | $125k-$140k/year

Collections Specialist – Westbrook, ME | $60k-$62k/year

Finance Leaders Prepare For a Pivotal 2026

A new report from The CFO Alliance, created in partnership with Oracle NetSuite, warns that 2026 is shaping up to be “the most pivotal year the finance function has faced in a decade,”. The insights come as finance leaders brace for a convergence of pressures expected to reshape the function in the year ahead.

According to the report, controllers, FP&A leaders, and roughly two dozen CFOs collaborated to outline the challenges and specific steps organizations can take to navigate them. The group points to several major forces at play, including AI disruption, increased capital pressure from boards and investors, heightened expectations around risk management and strategy alignment, and a growing need for agility amid broad structural shifts. These factors represent only the headwinds currently known.

The report includes targeted recommendations for finance teams preparing for this environment, including:

Strengthening Supply Chain Resilience

Finance leaders should consider dual-sourcing high-risk products, adding contractual protections such as indexed pricing or quarterly reopeners, and conducting consistent scenario planning. Suggested cadences include quarterly half-day sessions and monthly 30-minute check-ins.

Approaching AI Investment with Discipline

Moving too quickly on AI can lead to unclear ROI, fragmented systems, and security challenges. To avoid these pitfalls, the report encourages forming an AI steering committee, identifying top AI use cases within each function, and updating internal policies around acceptable AI usage. The report also reinforces that high-quality data remains central to any successful AI initiative.

Ensuring Strategic Alignment Across Leadership

CFOs risk credibility, and potentially their roles, when leadership teams are not aligned on strategy. To maintain clarity and unity, organizations are advised to publish a succinct, one-page “commander’s intent” outlining goals, nonnegotiables, and decision rights. Leadership should revisit these priorities monthly.

“The report reflects what we’re hearing from finance leaders across the market: 2026 is not business as usual.”

– Ranga Bodla (VP of field engagement, Oracle NetSuite)